It explains the core tax concepts and principles. Overview of Malaysian Taxation Q1 Double Taxation Agreement does not form part of the subsidiary legislation.

Chapter 1 Basis Of Malaysian Taxation Pptx Chapter 1 Basis Of Malaysian Income Tax Tax267 Taxation I 1 Learning Objective Objectives And Course Hero

The book will be invaluable for students pursuing.

. The foundation of the work is legislation extracted from the Income Tax Act 1967 Real Property Gains Tax Act 1976 and Goods and Services Tax 2014. PB - McGraw-Hill Education. Guide To Advanced Malaysian Taxation by Jeyapalan Kasipillai Mar 01 2013 McGraw-Hill Education Asia edition paperback Guide To Advanced Malaysian Taxation Mar 01 2013 edition Open Library It looks like youre offline.

The book will be invaluable for students pursuing. AU - Kasipillai Jeyapalan. It looks like youre offline.

The foundation of the work is based on the major tax legislation in Malaysia namely the Income Act 1967 Real Property Gains Tax Act 1976 Sales Tax Act 2018 and Service Tax Act 2018. A Guide to Malaysian Taxation Fifth Edition is an all-inclusive book covering every aspect of basic taxation. ER - Kasipillai J.

BT - A Guide to Advanced Malaysian Taxation. Q2 Define a person under the Income Tax Act 1967. This publication provides a concise yet comprehensive guidance on the essentials of Malaysian taxation to enable a working understanding of the law and practice of taxation in Malaysia.

A guide to malaysia taxtation is an all-inclusive book covering every aspect of basic taxtation. This book will prove invaluable for the. Is this statement true or false.

An individual employed in Malaysia is subject to tax on income arising from Malaysia regardless of where the employment contract is signed or the. Your Instructor Song Liew Services We provide various company secretarial business process outsource tax and consulting services to our clients. KPG2832 J49 2010 Available at Stacks.

A Guide to Malaysian Taxation Fifth Edition ISBN. Q3 The Government can introduce changes to the tax laws at any time to regulate and control the. The foundation of the work is based on the major tax legislation in Malaysia namely the Income Act 1967 Real Property Gains Tax Act 1976 Sales Tax Act 2018 and Service Tax Act 2018.

The book has been updated to reflect the latest tax amendments including th. Employment income - Gross income from employment includes wages salary remuneration leave pay fees commissions bonuses gratuities perquisites or allowances in money or otherwise arising from employment. 9789834728779 Based on 0 reviews.

A guide to Malaysian taxation Jeyapalan Kasipillai. Any foreigner who has been working in Malaysia for more than 182 days considered as residents are eligible to be taxed under normal Malaysian income tax laws and rates just like Malaysian nationals. Estimating the size and determinants of hidden income and tax evasion in Malaysia.

It covers all the latest amendments including those arising from the Budget 2013 and recently issued exemption orders. Čeština cs Deutsch de English en Español es. A guide to Malaysian taxation by Jeyapalan Kasipillai 2010 McGraw Hill edition in English.

Do foreigners or expatriates who are working and earning income in Malaysia need to pay income tax. Up to 5 cash back A GUIDE TO MALAYSIAN TAXATION is an all-inclusive book covering every aspect of basic taxation. Asian Review of Accounting 8 2 25-42 2000.

The coupon code you entered is expired or invalid but the course is still available. - Write a review. A Guide to Malaysian Taxation Fifth Edition REVIEW QUESTIONS CHAPTER 1.

J Kasipillai J Baldry DSP Rao. The foundation of the work is legislation extracted from the Income Tax Act 1967. A BIP Guide to Malaysian Taxation Everything you need to know about Malaysian Taxation off original price.

A Guide to Malaysian Taxation Fifth Edition is an all-inclusive book covering every aspect of basic taxation. CY - Selangor Malaysia. T1 - A Guide to Advanced Malaysian Taxation.

A practical guide to Malaysian taxation. A practical guide to Malaysian taxation by Jeyapalan Kasipillai 2000 McGraw-Hill edition in English.

Workplace Guide Sop For Resuming Work Business Operations

Updated Guide On Donations And Gifts Tax Deductions

Chapter 1 Basis Of Malaysian Taxation Pptx Chapter 1 Basis Of Malaysian Income Tax Tax267 Taxation I 1 Learning Objective Objectives And Course Hero

32bj Kaplowitz Ie 2 Pdf Taxes Politics Of The United States

Malaysian Taxation By Choong Kwai Fatt 21st Edition 2020 Hobbies Toys Books Magazines Textbooks On Carousell

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

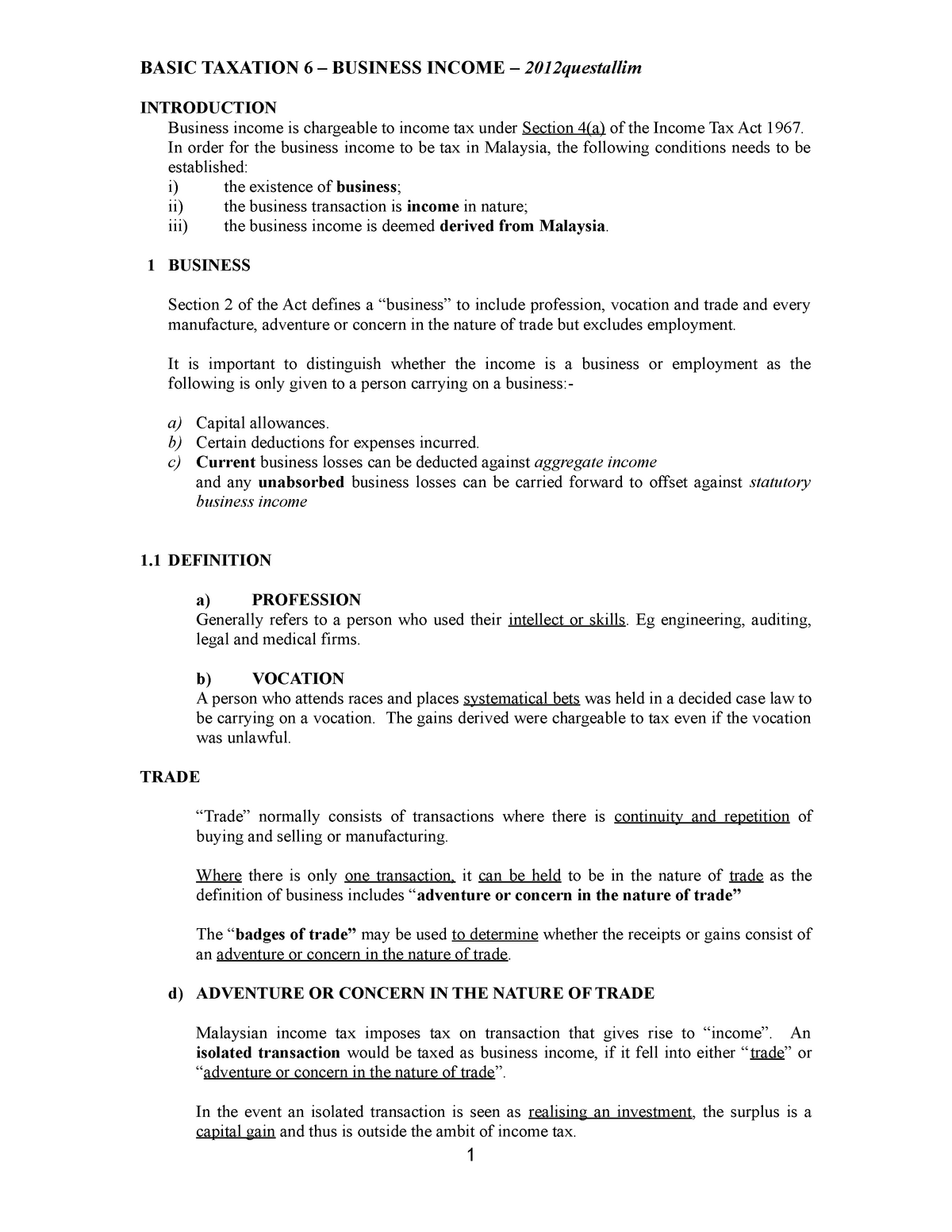

Malaysian Taxation Lecture 6 Introduction Business Income Is Chargeable To Income Tax Under Studocu

A Guide To Malaysian Taxation 5e

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Responsibilities Of Individual

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Chapter 1 Basis Of Malaysian Taxation Pptx Chapter 1 Basis Of Malaysian Income Tax Tax267 Taxation I 1 Learning Objective Objectives And Course Hero

Tax Basics For Expats In Malaysia Instarem Insights

Books Kinokuniya A Guide To Malaysian Taxation 5e Kasipillai Jeyapalan 9789834728779

Ckf Malaysian Taxation Hobbies Toys Books Magazines Textbooks On Carousell

Chapter 1 Basis Of Malaysian Taxation Pptx Chapter 1 Basis Of Malaysian Income Tax Tax267 Taxation I 1 Learning Objective Objectives And Course Hero